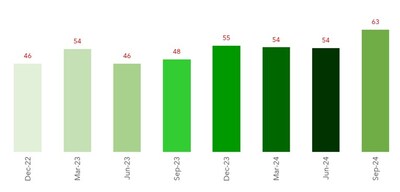

MUMBAI, India, Dec. 19, 2024 – Dun & Bradstreet, a leading global provider of business decisioning data and analytics, along with SIDBI, released SPeX (also known as the ‘Green Pulse Indicator’) for July-September 2024, which evaluates the perception of sustainability among MSMEs across three key dimensions: willingness, awareness, and implementation. The index revealed a 30% jump in willingness during July – September 2024 followed by awareness, which saw a 4% increase to 62; while implementation dropped 15% to 41 compared to the previous quarter. Both the willingness and awareness dimension increased, and implementation fell from the last year quarter.

The SPeX index value ranges from 0 to 100, with an increase in index value indicating enhanced perception of MSMEs towards sustainability. The overall SPeX value reflects changes within these dimensions, providing insights into how MSMEs understand, are willing to engage, and implement sustainability measures. An increase in SPeX suggests a positive shift in MSMEs’ perception and practices towards sustainability measures. A decrease may indicate challenges or a decline in willingness or implementation.

Dr. Arun Singh, Global Chief Economist, Dun & Bradstreet, said, “MSMEs are increasingly committed to sustainability, but financial and technological barriers still hinder real progress. In Q3, the SPeX index surged across all business sizes, signaling rising awareness and a shift toward change, particularly among younger firms. However, translating sustainability ambitions into concrete actions remains a significant challenge. From overhauling production processes to adapting to new regulations, MSMEs face critical obstacles. To unlock their potential, targeted support is essential empowering these businesses to turn their green ambitions into impactful realities and drive the transition to a sustainable economy.”

Dr. R.K Singh, CGM, SIDBI, stated, “SPeX endeavours to be a tracker of MSMEs’ intent and preparedness to go for green investments. This also helps us to customise our solutions aimed at inducing MSMEs to align to value chain expectations on responsiveness. SIDBI – D&B Sustainability Perception Index Survey, July – September 2024 indicates upward movement in the SPeX score, indicates growing orientation to emerge responsive. This would require augmenting the capacity building, orientation and awareness on enterprise side to realise this dream. The level of implementation needs a fillip across all sizes of enterprises. SIDBI has prioritized the Greening of Enterprise Ecosystem. SIDBI’s Panchtatva missions viz. Energy Efficiency, E-Mobility, Renewable Energy, Circular Economy and Adaptation Finance (Nature based Solutions) through panchtools viz. Development, Financing, Risk Mitigant Models, Thought Leadership and Synergy 4 Energy (Global good practices) are oriented to enhance the acceptability amongst MSMEs to “Go Green” and adopting Environmental & Social (E&S) practices for holistic improvement in the enterprise thereby making more resilient, competitive, sustainable operations / practices / products / services.”

Highlights of the SPeX Report:

• In Q3 2024, firms showed increased familiarity with environmental and governance (ESG) practices, with smaller firms generally aligning to this trend.

• Profitability and stakeholder appeal were widely recognized as key benefits of sustainability, with small and medium-sized firms particularly noting its positive impact on attracting employees, investors, and customers. Younger firms (less than 10 years) focused more on profitability and stakeholder appeal, while older firms (over 10 years) emphasized brand image in addition to stakeholder relations.

• MSMEs, particularly small and medium-sized firms, increasingly see ESG as a potential competitive advantage in Q3 2024.

• Throughout 2024, MSMEs prioritized environmental initiatives and employee welfare. Smaller firms, however, focused less on compliance and social welfare. Younger firms (under 5 years) placed more emphasis on employee training, while firms over 5 years old balanced environmental measures with employee welfare.

• Cost reduction or efficiency gains remain the main drivers for adopting sustainability measures, consistently highlighted as the top motivator throughout 2024 and 2023. Regulations also play a key role, and younger firms place more importance on stakeholder willingness to consider sustainability initiatives.

• While over 50% of MSMEs are building expertise in key sustainability areas, the percentage of firms with expertise or plans to build such expertise declined in Q3 compared to Q2, with micro firms showing the largest decline. Younger firms focused more on business strategy, sustainable policies, and waste management.

• The proportion of MSMEs likely to implement new sustainability measures in the next two quarters dropped from 79% in Q2 to 49% in Q3, with 31% undecided and 19% unlikely to act.

• In Q3, MSMEs prioritized energy-efficient equipment and recycling initiatives, with medium and small firms making the most progress. Older firms focused on compliance, ethical sourcing, and energy efficiency.

About Dun & Bradstreet:

Dun & Bradstreet, a leading global provider of business decisioning data and analytics, enables companies around the world to improve their business performance. Dun & Bradstreet’s Data Cloud fuels solutions and delivers insights that empower customers to accelerate revenue, lower cost, mitigate risk and transform their businesses. Since 1841, companies of every size have relied on Dun & Bradstreet to help them manage risk and reveal opportunity. For more information on Dun & Bradstreet, please visit www.dnb.com.

Dun & Bradstreet Information Services India Private Limited is headquartered in Mumbai and provides clients with data-driven products and technology-driven platforms to help them take faster and more accurate decisions in domains of finance, risk, compliance, information technology and marketing. Working towards Government of India’s vision of creating an Atmanirbhar Bharat (Self-Reliant India) by supporting the Make in India initiative, Dun & Bradstreet India has a special focus on helping entrepreneurs enhance their visibility, increase their credibility, expand access to global markets, and identify potential customers & suppliers, while managing risk and opportunity.

India is also the home to Dun & Bradstreet Technology & Corporate Services LLP, which is the Global Capabilities Center (GCC) of Dun & Bradstreet supporting global technology delivery using cutting-edge technology. Located at Hyderabad, the GCC has a highly skilled workforce of over 500 employees, and focuses on enhanced productivity, economies of scale, consistent delivery processes and lower operating expenses.

Visit www.dnb.co.in for more information.

Click here for all Dun & Bradstreet India press releases.

About SIDBI:

Small Industries Development Bank of India (SIDBI) in its role as the Principal Development Finance Institution for MSME sector has played a significant role in developing the financial services for MSME sector through various interventions including Refinance to Banks, Credit Guarantee programs, Development of the MFI sector, Contribution to Venture capital/AIF funds, MSME ratings, promoting digital lending ecosystem, etc. The Bank has proactively been working toward Energy Efficiency (EE) in MSMEs since 2005-06 as part of Direct Finance business using support of multilaterals like World Bank, ADB, GiZ, FCDO, JICA, AFD, KfW etc. for energy efficient projects. SIDBI has taken steps to promote Energy Efficiency and Cleaner production in the MSME sector and propose to accelerate its efforts for MSME sector for their survival, growth and competitiveness in long run during prevailing climate related challenges.

Looking to importance of ESG aspects and the need for a simplified, Customised ESG risk rating framework, SIDBI has already started integration of ESG framework into its operations. Subsequent to setting up of Green Climate Finance Vertical for prioritised focus, a Board level Committee has been constituted for guidance, oversight and monitoring on ESG, Green Strategy of the bank, including relevant SDGs etc. To lead with the example, SIDBI has set a target to become Carbon Neutral by 2024 and Net Neutral organization in subsequent years.

Through Green Financing products and other developmental activities, SIDBI enables the manufacturers and service providers in MSME sector to adopt green energy efficient technologies helping in lesser waste leading to positive impact on environment and sustainability.

Visit www.sidbi.in for more information.