New Delhi India, December 10: Union Mutual Funds one of its kind NFO “Union Active Momentum Fund” is closing for Subscription on Thursday, the 12th December 2024. The Union Active Momentum Fund NFO is open for subscriptions from November 28, 2024 and closes on December 12, 2024 and will re-open within 5 business days from allotment.

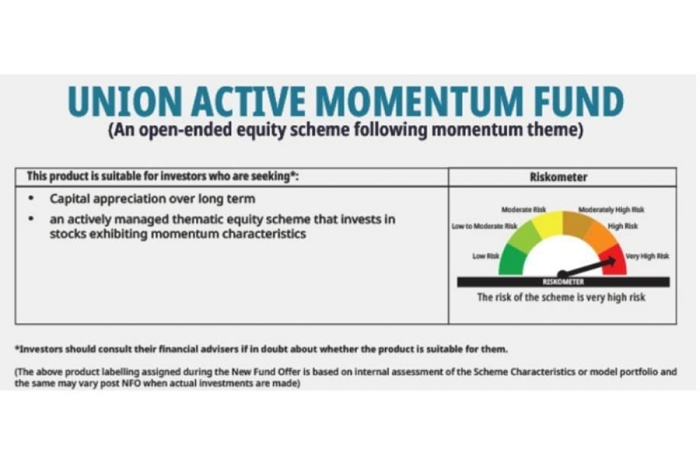

Union Mutual Fund recently announced its entry into Factor Based investing with the launch of its new fund offer – Union Active Momentum Fund (An open-ended equity scheme following momentum theme) that will invest in stocks showing momentum.

The Union Active Momentum Fund, follows a proprietary quantitative model that has been rigorously back tested for more than 15 years. The model has many factors namely historical price performance, volatility of returns, relative strength, liquidity etc. to name a few. It involves targeting specific and quantifiable factors of returns in stock markets, such as Value, Growth, Low Volatility and Momentum.

This fund aims to provide investors with a rules-based strategy to invest in stocks that exhibit momentum characteristics. Investments shall be made purely based on a rule- based mechanical approach, which eliminates emotional biases, ensures flexibility in execution, enables disciplined entry and exit points, and facilitates timely corrective actions through continuous monitoring of outcomes.

Gaurav Chopra, Co-Fund Manager commented “Investor sentiment is one of the guiding forces behind stock price movements. Momentum Investing is a rule-based approach with the goal to work with volatility, buy what is rising and sell when they start losing”

Sanjay Bembalkar, Head Equity added “Momentum arises from how investors act on information, driving stock prices up and creating momentum, and vice versa.”

Madhu Nair, CEO, Union AMC remarked “Our promoter group Daiichi Holdings has a wholly owned subsidiary Vertex Investment Solutions reflecting the growing interest in rule based active investing. Union Active Momentum Fund marks our inaugural foray into this exciting world of Factor based investing. We are bullish on this category and believe Smart Beta strategies like Active momentum will have larger role to play in Indian equity markets.”

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.