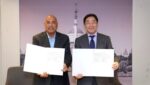

New Delhi, 02 June 2022: Clix Group (Clix Capital and Clix Finance), a leading non-banking financial services group with a strong pan-India presence, has entered into a strategic partnership with Tezzract Fintech Private Limited, to innovate and bring new age solutions for lending to MSMEs in India. Under this partnership Clix aims to lend an additional INR1000 crore to MSMEs by the end of this year.

Through this partnership, both companies will build solutions to plug the significant challenges that MSMEs face in raising funding to grow and compete in an already difficult post-Covid environment. With the rising inflation and higher interest rate environment, this partnership aims to use significant data points to help small companies raise funds timely and at competitive rates.

Rakesh Kaul, CEO- Clix Capital, expressing his thoughts on the collaboration, commented, “We’re glad to get into a strategic alliance with Tezzract Fintech Private Limited because of their cutting edge technology prowess. Together, we aim to disburse INR 1,000 crore to MSMEs in FY23. Tezzract is building proprietary technology that we can leverage to solve various needs of MSMEs through their evolution, helping maximize lifetime value benefits and reducing transactional costs for them.”

The partnership will not be limited to only sourcing MSME customers for Clix, but will work on jointly building co-origination and co-lending opportunities with banks and NBFCs. In the next 15 months, Clix and Tezzract are targeting to make an MSME liability marketplace- where banks and other financial institutions can participate to pick up loan assets across secured and unsecured assets.

Shaili Maheshwari Kajaria and Vivek Raghavan, Co-Founders of Tezzract, said, “We are super excited for this long-term partnership where, with Clix group’s significant strengths and our Tez agility we will create a powerful solution that will help build a sustainable AUM for Clix and other co-lenders. Under the CLIX-TEZ partnership we have a product-agnostic – customer first thought process. No – Touch frictionless Tez tech along with Clix’s strong balance sheet support will enable our INDIA MSME CREDIT CLUB vision. At Tez – mind share and wallet share of customers are both equally important.”

The partnership will play an instrumental role in heralding innovation and revolutionizing the lending space through Clix Group’s differentiated digital lending products and Tezzract’s cutting edge technology and deep analytics driven approach. Both entities will work together to explore and build products to best cater to MSME as a category and further their purpose of serving the underserved needs of millions of Indian MSMEs.

About Clix Capital

Clix Capital is a new age NBFC revolutionizing the lending space by offering differentiated digital lending products driven by technology and deep analytics. Its range of lending products to a varied spectrum of customers across the MSME and consumer segment includes personal loans, MSME loans, healthcare loans and mortgage finance.

Co-founded by industry veterans Mr. Pramod Bhasin and Mr. Anil Chawla, Clix is backed by private equity fund AION Capital Partners Limited (an affiliate of Apollo Global Management, LLC – one of the largest alternate investment managers globally with an AUM of $513 billion). Mr. Bhasin is the founder of Genpact and the former CEO of GE Capital India and Asia while Mr. Chawla has been the former CEO of GE Capital India and Asia’s Commercial Finance Business.

Together, Mr. Bhasin, Mr. Chawla and AION jointly acquired the commercial lending and leasing business of GE Capital India in September 2016 and rechristened it as Clix Capital.

About Tezzract

Tezzract is a fast-growing 4-month-old MSME fintech. It has developed an end-to-end paperless digital journey for customers along with robust Machine Learning algorithms for centralized underwriting of MSMEs.

Tezzract, has adapted to technological advancements by expanding its suite of services to include AI and Data Analytics. In addition, the company offers a comprehensive lending tech stack that can effectively manage individual user lifecycles and co-lending partnerships. Tezzract currently has 80 employees and 22 offices, with plans to expand to 100 cities across India.

This is second venture for Tezzract founders after their first venture KapitalTech. They successfully exited that venture having disbursed 2200 cr, profitably across 50+ locations in India.