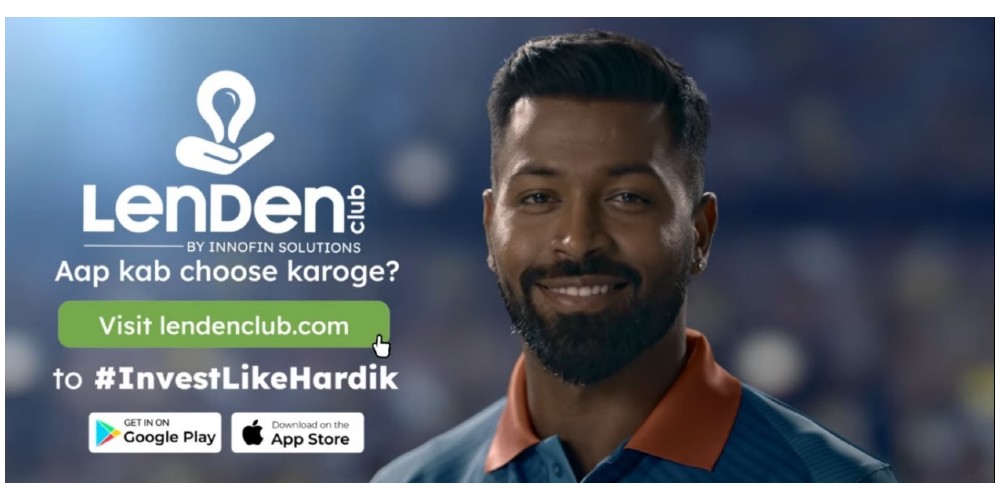

Mumbai, 16th March 2023: LenDenClub, India’s leading Peer-to-Peer lending platform has launched a new campaign with its brand ambassador Hardik Pandya. The new campaign named ‘Invest like Hardik’ by LenDenClub emphasizes new-age investors to invest in P2P lending that is hassle-free and offers high returns compared to traditional asset classes.

The new campaign aims to create awareness among investors to invest in new-age investment avenues like Peer-to-Peer lending, which is convenient and enables the investor to earn high returns while being non-market linked. The campaign anchored by Hardik underlines the messaging of being audacious and fulfilling your dreams by choosing the right investment class.

The campaign features Hardik Pandya as the protagonist engaging in amusing banter with the audience to showcase the benefits of investing in Peer-to-Peer lending while highlighting the industry-best product offerings of LenDenClub. The film displays various attributes of Hardik that have a direct correlation with his choices. The choice of having the tattoos he wants, maintaining a healthy lifestyle while being the life of the party, being disciplined at all times and finally improvising in the middle of the pitch – every sequence has been designed to bring alive the fearless story.

With Hardik Pandya’s affiliation with the world of cricket, the brand intends to entice people from all genres, for instance, users who have an affinity towards investing in various financial instruments, salaried individuals, novice investors, entrepreneurs and investors. Besides, it also aims to bank big on the mass appeal of Hardik among cricket enthusiasts.

Addressing audiences where Hardik Pandya after celebrating his big win on the ground says ‘Meri choices hamesha se hi different rahi hain.’ The campaign aims to quickly connect with audiences while riding on the different attributes of the cricketer. While building a unique appeal among audiences, the campaign seeks to enhance trust in investing while displaying the ease and simplicity of investing in Peer-to-Peer lending with LenDenClub.

With a lucid montage of stills and snippets featuring the ace cricketer, rocking background music, and a straightforward statement, the brand manages to make a mark as subtle and as powerful as the cricketer’s stint in sports.

Commenting on the new campaign, Mr Bhavin Patel, Cofounder and CEO, LenDenClub, said, “As a company, we have constantly been evolving to provide the best returns to our customers that transcend from understanding the customer sentiments to creating developments that encourage investing in P2P lending. With this alliance, we aim to raise attention to Peer-to-Peer (P2P) Lending.

The campaign thus ties back beautifully to our brand and what it stands for whilst showcasing how to avail simple and hassle-free investing through LenDenClub. Considering Cricket has always been more than just a sport in India, launching this campaign with Hardik Pandya further reiterates our resolve for mass appeal. I am sure that our 2 million investors will be able to resonate with Hardik’s brand personality as they also made a different choice when they decided to invest with LenDenClub.”

Commenting on the creative direction of the campaign, Saarthak Juneja, Creative Lead at Kandid Kanvass, the agency behind the campaign, said, “After Hardik Pandya came on board as the brand ambassador, it became imperative that each and every aspect of the creative campaign be reflective of his personality which fits with the LenDenClub brand perfectly. They both stand for effective unconventionality that works really well in this modern, to-each-his-own world.

In keeping with Hardik’s vivacious persona, the script, the treatment, the rap song treatment of the background score – all were consciously crafted to be peppy, fast-paced, fun and in-your-face bold. LenDenClub intends to be fearless just like Hardik. And it works. Just like Hardik’s non-traditional, unique choices.”

On the choice of Hardik Pandya as LenDenClub’s maiden campaign, Roneeta Ghosh, Business Lead at Kandid Kanvass, believes,”LenDenClub is a pioneer in the fintech sector, a cutting edge P2P platform – ideal for today’s new-age, modern investors. While deciding on the brand ambassador we felt we needed a dynamic and iconic personality like Hardik Pandya who is perfectly placed to be able to inspire today’s young India and be the most credible face for the brand. People both look up to him and respect him for creating his own unique path, something that aligns with LenDenClub’s intentions.”

Hardik Pandya’s resilient personality has always delivered high returns on the ground, just as LenDenClub offers the same to its investors in the new-age Peer-to-Peer lending platform. Despite his different choices, they have consistently given him an edge above the rest. The all-rounder will display LenDenClub’s core values of knowledge, trust, & authenticity.

Campaign Video – Invest like Hardik | LenDenClub X Hardik Pandya

Hardik Pandya’s Instagram – #InvestlikeHardik Reel

About LenDenClub

LenDenClub is India’s largest Peer-to-Peer (P2P) Lending platform, owned and operated by Innofin Solutions Pvt. Ltd., an RBI-registered (NBFC-P2P). It provides an alternate investment opportunity to investors or lenders looking for high returns by connecting them with creditworthy borrowers looking for short-term loans. In the past three months, its flagship product, FMPP, has provided returns of more than 10% p.a. to 100% of the investors. The AI & ML-powered platform encourages investors to start investing in P2P lending with a minimum investment of Rs 10,000 and hyper-diversifies their funds to as low as ₹1 per borrower, leading to risk-mitigated and stable returns to investors.

Founded by Bhavin Patel and Dipesh Karki, LenDenClub has disbursed loans of over ₹11,000 crores and has an active investor base of over 20 lakh investors. In 2022, they also launched a corporate venture capital for early-stage Tech and FinTech startups, offering them acceleration through mentorship and access to capital.