Zaggle further strengthens its product line, provides easy access to affordable credit

CASHe aims to disburse Rs. 100 crore worth of loans through Zaggle

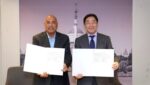

Mumbai, March 22, 2022: Zaggle, a profitable SaaS FinTech company and a pioneer in digitizing business spends for corporates, has partnered with CASHe, India’s preferred AI-driven financial wellness platform to offer next-gen lending facility to salaried professionals on its network. With this partnership, the company aims to offer a host of affordable and customised credit solutions offered by CASHe to millions of users.

With this collaboration, Zaggle aims to expand its product portfolio by offering affordable and instant lending solutions to its users. Zaggle users can now seamlessly avail a host of new-age, customised credit products from CASHe including of personal loans, credit line and BNPL to fulfil their financial needs. Users can avail a wide variety of loans ranging from Rs. 1,000 to Rs. 3,00,000 with a repayment tenure of up to 1 year.

For CASHe, the partnership will mean latching on to the extensive user base of Zaggle, across its vast network of over 4500 corporate clients. Catering to its core target audience of working professionals, CASHe aims to further enhance its reach for its short-term retail loans and credit line offerings through the partnership. CASHe is eyeing to disburse loans worth Rs. 100 crores, leveraging Zaggle’s network.

Speaking about the partnership, Raj N, Founder and Chairman, Zaggle said, “The pandemic has re-emphasised the importance of providing easy access to credit to the underserved, as well as professionals so as to support broader economic growth. We are delighted to partner with CASHe and thereby facilitate our millions of its users with easy access to credit. Offering credit to our customers also enhances Zaggle’s product offerings significantly besides providing impetus to our growth momentum. Our customers are now even more empowered to unlock their dreams through credit and turn them into reality.”

Mr. V. Raman Kumar, Founder Chairman of CASHe said, “Credit is oil to economy. With the gradual resumption of economic activities, offering working professionals a seamless access to credit is crucial to drive the momentum as we emerge from the shadows of the pandemic. As part of our Vision 3.0, CASHe is building new partnerships and extending its product suite to cater to a wider range of customers while offering superior user experience entailing just a few taps on the smartphone. We are extremely excited to partner with Zaggle and aim to serve their massive customer base with our top-notch credit products.”

Zaggle which is one of the pioneer in digitising corporate spends in India, has witnessed rapid growth journey since its inception in 2011. Starting from a gross transaction value (GTV) of just Rs 4 crore in 2012, Zaggle has today grown to a GTV of about Rs. 15,000 crores in the $1 trillion addressable Indian spend management market. Zaggle provides expense management system and employee rewards and recognition program services to companies, and the company has been regularly expanding its product line. The company has witnessed strong growth in FY21 with revenues of Rs. 225 crore and profit of Rs. 27 crore and the overall growth and profit momentum continues to be strong in FY22 as well.

Envisioning to build a full-stack credit-led financial wellness platform, CASHe has been constantly growing its product suite and expanding its footprint across the country. A leading digital lending platform with robust credit lending system, CASHe caters to a loyal customer base of over 4 lakh and currently owns a loan book of Rs. 3,700 crore. With this partnership it aims to continue scaling up its business whilst delivering the best possible digital credit experience to its rapidly growing customer base. With record disbursements, client acquisitions, top line growth, profitability, and distinct product offerings, CASHe has seen spectacular growth in FY 21-22. The company recently closed 140 crores of equity funding from its Singapore-based holding company TSLC Pte Ltd.

The digital lending space is hot and booming in India. More than 80% of Indian millennials are planning on acquiring personal loans for manifold reasons. With the rapid adoption of digitization, the lending landscape in India has changed substantially, and thanks to the FinTech industry, India has seen a massive adoption in bringing flexibility and versatility to the younger audiences for lending.

About Zaggle

Zaggle is a profitable SaaS FinTech company that is digitizing business spends to drive growth and unlock value through innovative and automated workflows. Zaggle was founded by Raj. N, a serial entrepreneur and an active angel investor with a vision to become a global digital bank. The company began its journey in 2011 with the vision of developing a digital ecosystem that would connect corporations and their users with partner merchants through its innovative FinTech solutions. Since its inception, Zaggle has been working on evolving technologies that have helped the company to develop relevant solutions and platforms that are in raging demand in the contemporary times. Our specialty lies in arraying cutting edge technologies viz., AI (Artificial Intelligence), ML (Machine Learning) and OCR (Optical Character Recognition) which are conducive in facilitating a seamless experience to our users. At present, Zaggle is closely working with IndusInd, RBL, NSDL Payments Bank and YES Bank and RuPay, VISA and MasterCard.

Currently, Zaggle has 4,500+ clients, 12000+ merchants and over 4.5 million users. The company has offices across 9 cities with 350+ employees and is committed to bringing the best in class user experience to its users.

Zaggle’s Solutions:

•Save: Save is a spend management, employee reimbursements and benefits platform that enables companies and their employees to save by digitising, organising and aggregating their spends. The entire process is digital which facilitates complete transparency in terms of the spend being on the correct category and making the process entirely seamless and enabling users to effortlessly manage their spends. The platform is powered by AI and ML which can easily identify and duplicate bills and helps companies save more annually.

•Propel: Propel is an employee rewards & recognition and channel incentivization solution that enables companies to communicate, engage, motivate and reward its employees and channel partners to drive growth. It helps in solving the intricate issues that involve the management of the complete lifecycle of sales incentives right from the development of schemes until the end-users receive it including analytics and reconciliation. This platform manages all your reward programs from a single integrated platform to increase productivity, greater profitability and reduced attrition.

About CASHe

Headquartered in Mumbai, CASHe is a credit-enabled financial technology platform that offers consumer lending products like quick personal loans, buy now pay later and credit line services to salaried millennials. Launched in 2017, CASHe provides hassle-free financial assistance to help people take control of their personal finances regardless of credit score by utilizing its proprietary decision models that is powered by its AI/ML backed platform called the Social Loan Quotient, to assess a person’s true ability and willingness to repay, leading to considerable reduction in the average cost of credit. CASHe has disbursed loans over Rs 4,000 crores to 4 lakh customers. Starting as a personal loan app which has been downloaded over 14 million times, CASHe is now a full-fledged financial services platform that offers its customers with credit, insurance and EMI shopping.